Is it still vodka rather than wine?

There is wide-ranging contrast in the way young Russian consumers rate Western products.

Since the fall of the Iron Curtain and the consequent freeing-up of the market place, Russian consumers have had open access to Western products. Western European manufacturers have discovered that their Eastern neighbors are an interesting new market. Yet many entrepreneurs have only a vague or false picture of the needs and desires of the Russian consumer. Not every Western product is received enthusiastically, and consumer loyalty to trusted Russian products is high. The ESN member ISI (Institut für Sensorikforschung und Innovationsberatung GmbH) in Goettingen, Germany, has put the consumption habits and attitudes of young Russian consumers under the microscope.

In a wide-ranging quantitative study, the ISI researchers conducted interviews in Moscow, St. Petersburg, and two other Russian cities, using a representative random survey of 1033 young Russians between 16 and 30 years old. Those surveyed were questioned about their buying and eating habits. All those questioned had by their own estimation enough money to buy the necessary food and luxury items. The results presented a complex picture:

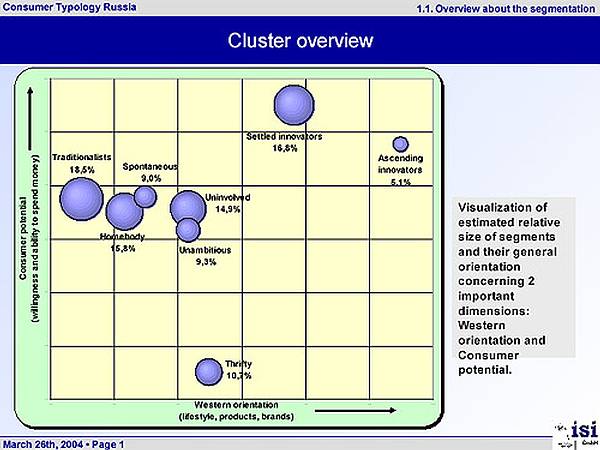

Eight separate consumer types were identified. Through statistical analysis, these types could clearly be separately categorized (see illustration). This was also the case with regards to their pro-Western orientation as well as their willingness to buy, as well as their perspective purchasing power. It was clear that at present, a relatively small number of Russian consumers are receptive to products molded in the Western style. On the contrary, a perceptibly larger number tend to gravitate towards well-known domestic products and manufacturers and continually give them more positive ratings than the foreign products.

"Western suppliers cannot automatically count on their products being accepted with open arms in the Russian marketplace", states Robert Möslein, the leader of the ISI study. "In this case we suggest a diversified strategy."

Möslein sees the best chances for the typical sort of Western products, such as potato chips, cola, and wine, in the two social groups, "up-and-coming innovators", and "established innovators". People in these groups see foreign products as change and enrichment in their life styles.

Especially in the group "up-and-coming innovators", Möslein sees a growing new social layer that has fewer ties to traditional Russian products than does the rest of Russian society. For them, Western products are a part of the connection to a new lifestyle and its concurrent sense of exuberance. Young Moscovites between the ages of 16 and 20 who cultivate a pronounced Western-oriented lifestyle are especially heavily influenced. The somewhat older "established innovators" are first and foremost interested in high-quality goods, and enjoy the luxury of exotic cooking using foreign foodstuffs.

In a wider social framework of interests - beyond the groups of "innovators" - Russia is pushing for new products such as coffee and toothpaste.

To find a way into the more conservative segments of the Russian market , Möslein suggests that Western companies' best strategy would be to cooperate with Russian suppliers as well as to make market adaptations taking into consideration traditional Russian sensory experience. This strategy is particularly relevant with regards to milk products, snacks, and beverages. "Many Russian consumers have strong reservations concerning Western products. They follow the dictum 'Russian lemonade is made from lemon juice; Western lemonade contains only sugar and artificial flavoring'", say the experts. Some focus groups found health foods and advantageous food additives, such as vitamin supplements, interesting ideas; nevertheless, in general, what was of prime importance to the Russian consumers was their emphasis on the aspect of product enjoyment.

Source:

ISI GmbH; Güttingen, Germany

Robert Möslein